China Exchange Rate Regime and Monetary Policy in the

Perspective of People’s Bank of China

Introduction

The official currency of the People’s Republic of China is renminbi (RMB), which also well known as Yuan. According to economist (2015), the yuan has been one of the highest performing currencies in the world. China is trying to build a floating exchange regime in these years, which may influence global economy. Therefore, to help more people know more about China exchange regime becomes an important issue for policy makers and economics students. The purposes of this paper is to provide some general information about China exchange regime for policy makers and economics students. Three sections are included in this paper: introduction of China exchange rate regime and some tools of monetary policy; an analysis about the floating exchange rate in a specific period (Aug. 10. 2015 to March.31.2016); the influence of exchange rate to society and some groups of people.

China Exchange rate regime

Introduction

The central Bank of China is the People’s Bank of China (PBOC), which takes responsibilities to make monetary policy to manage financial market. China exchange rate regime is in a reform process. In 2005, China announced a reform plan about to build a floating exchange rate regime. According to PBOC (2010), China establishes a managed floating exchange rate regime based on market demand and supply with reference to a basket of currencies. However, China still has very strong monetary policies to manage exchange rate.

China exchange rate regime includes three key aspects (PBOC, 2010). These aspects try to explain exchange rate regime clear. First, exchange rate fluctuations bases on market demand and supply to take the advantage of price signalization of exchange rate. Second, basing on current account especially trade balance to adjust the floating band. Third, the exchange rate bases on a basket of currencies and do not focus on a specific currency bilateral exchange rate.

Benefits of floating exchange rate regime reform

China can get several benefits form floating exchange rate regime reform (PBOC, 2009). Because China is trying to transform his economy structure, so the reform of exchange rate can accelerate this process. First, floating exchange rate regime is good for the independence of monetary policy and enhance the power of financial control. Second, floating exchange rate regime can benefit the balance between imports and exports to improve international trade situation. Third, China also can get benefits form floating exchange rate regime to keep price level remain stable and decrease business cost. Finally, floating exchange rate regime can help China transform the mode of foreign trade growth to improve international competitiveness and enhance the ability of resisting risks.

Tools of monetary policy

Monetary policy is central bank uses some tools to adjust money supply to influence interest rate, which can affect capital market, to achieve the goals of macro-economy. In general, there are two kinds of monetary policies: expansionary monetary policy and contraction monetary policy. Expansionary monetary policy always increases money supply and contractionary monetary policy decreases money supply. In China, there is a special monetary policy, which is sound monetary policy. The goal of sound monetary policy is avoiding inflation and deflation (Xinhua.news, 2009). However, this goal does not affect PBOC takes some expansionary or contractionary monetary policy. Because expansionary and contractionary monetary policy are tools for China government to keep exchange rate stable.

Required reserve ratio

Required reserve is an amount of money prepared by financial institutions to guarantee they have enough money for their clients when they need withdraw or capital settlement. So the required reserve ratio is a specified percentage of deposits that commercial bank must hand over to central bank as a reserve.

Central bank use required reserve ratio to adjust money supply. When financial market suffered money shortage, central bank would decrease required reserve ratio. On the contrary, when money supply excess, central bank would increase required reserve ratio to reduce money supply. The changing of required reserve ratio would affect exchange rate, because required reserve ratio influence money supply. High money supply would cause currency devaluation.

Open market operations

Open market operations are another tools for PBOC and other countries’ central bank. Central bank can buy or sell securities in the open market, or do foreign exchange trading to achieve the goals of their monetary policy. By taking open market operations, central bank can manage money supply, which can efficiently affect exchange rate. For PBOC, open market operations include repurchase transaction, cash transaction and buying or selling central bank bills. According to PBOC (2013), PBOC build Short-term Liquidity Operations as a supply of open market operations.

Central bank loan

Central bank loan is a kind of loan which central bank lend to commercial bank. Central bank can adjust the amount and the interest of central bank loan to manage money supply. For PBOC, central bank loan did not important as before in recent years, because macro-control policy became more indirectly (PBOC, 2010).

Interest Rate Policy

Interest rate policy is a tool used by central bank to influence money supply and demand to achieve goals of monetary policy. For PBOC, tool of interest rate includes adjusting central bank’s benchmark interest rate; adjusting financial institutions legal loan interest rate; adjusting the floating range of loan and interest rates; and making policy to manage the structure of interest rates.

The key tool of interest rate of PBOC is adjusting central bank’s benchmark interest rate, which includes refinance interest rates, rediscount interest rate, required reserve ratio and excess required reserve ratio. By adjusting these factors, PBOC can manage money supply when necessary to reduce financial risk.

Standing Lending Facility

Standing Lending Facility is a common tool of monetary policy in the world, but different countries give it different names, for example discount window (USA) and operational standing facility (UK). China established standing lending facility in 2013 (PBOC, 2013). For PBOC, the transaction objects always are national commercial banks and policy banks, because these banks can influence macro economy in a short term. By using standing lending facility, PBOC can solve the shortage of money supply in a period, especially in spring festival. Spring festival is the most important festival in China, and most company would make a settlement for the year to pay bills, salary and performance bonus. Most people also withdraw money to enjoy their festival with their family. Therefore, the money demand is very high in this period. To avoid money shortage before spring festival, standing lending facility can play an important role in China economy. This phenomenon is a unique problem in China, and other countries may not have the problem.

An analysis about exchange rates of renminbi to dollar floating during Aug. 10. 2015 to March.31.2016

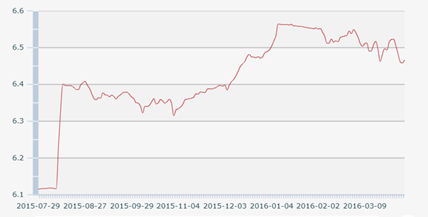

Chart 1: exchange rate from Aug.10.2015 to March.31.2016

Data and charts from PBOC (http://www.pbc.gov.cn/rmyh/108976/109428/index.html)

A general description about this period

This period is very strange in these years. The exchange rate of renminbi to dollar is very stable before Aug.10.2015, floating around 6.10. However, starting with Aug.10.2015, the exchange rate suddenly increases to 6.3306 by only 3 days. The exchange rate still kept floating and finally increase to the peak (6.5646) in this period. It is important for scholars to identify the reason of the extreme fluctuations and to know how PBOC used monetary policy to keep renminbi stable.

This paper divides this period into three periods to make a clear analysis about the exchange rates of renminbi to dollar. The first period is from Aug. 10. 2015 to Nov. 2. 2015. The second period is from Nov. 3. 2015 to Dec. 31. 2015. The third section is form Jan. 1. 2016 to March. 31. 2016. All analysis about these periods will follow this structure: A description about this period; the reasons, which caused renminbi depreciation; monetary policies took by PBOC to keep renminbi stable.

The first period (Aug. 10. 2015 to Nov. 2. 2015)

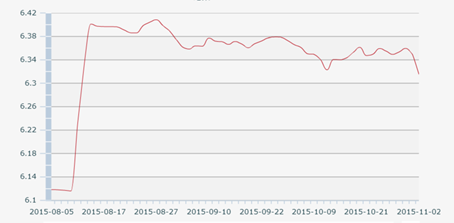

Chart 2: exchange rate from Aug.10.2015 to Nov.2.2015

Data and charts form PBOC(http://www.pbc.gov.cn/rmyh/108976/109428/index.html)

Only three days, the exchange rate of renminbi to dollar increased from 6.1162 to 6.3306. Exchange rates kept floating around 6.34. The highest point is 6.4043 in Aug.27th; the lowest point is 6.1162 in Aug.10th. At the end of this period, the exchange rate is 6.3495. Therefore, in this period, renminbi depreciated for 3.8%.

There are two reason to explain what happened in this period. First, China is trying to change economic structure in recent years. In some areas, local government shut down heavy polluted factories. In the east area, labor-intensive industry does not have enough order from foreign countries, so they cannot provide enough jobs. According to the third quarter report (PBOC, 2015), the GDP growth in the third quarter is 6.9%, comparing with the third quarter of 2014. China economy was keeping growth, but it is slowing down. Second, the US economic was keeping recovery in this period. The growth of seasonally adjusted QoQ of second quarter is 3.9%; inflation also remained subdued; and unemployment was keeping decrease (PBOC, 2015). These reasons made dollar very strong in this period.

In this period, PBOC decreased required reverse ratio two times. The first time was in Aug. 25. 2015. By this time, required reverse ratio decreased 0.5% (PBOC, 2015). The second time was in Oct. 23.2015; the required reverse ratio also decreased 0.5% at this time (PBOC, 2015). PEOC was also active in the open market. PBOC used reverse repurchase policy for ten times in this period.

The second period (Nov. 3. 2015 to Dec. 31. 2015)

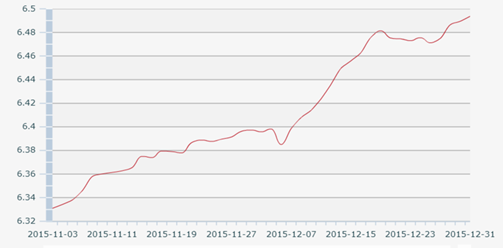

Chart 3: exchange rate from Nov.3.2015 to Dec.31.2015

Data and charts form PBOC(http://www.pbc.gov.cn/rmyh/108976/109428/index.html)

In this period, the exchange rate of renminbi to dollar was keeping increasing most of time. The start date of this period is the lowest point; the end date of this period is the highest point. The highest point is 6.4936 in Dec.31th; the lowest point is 6.3310 in Nov.3th. At the end of this period, the exchange rate is 6.4936. Therefore, in this period, renminbi depreciated for 2.5%.

There are four reasons leaded to the exchange rates increase in this period. First, China is in an economy downturn in this year. Comparing with the last quarter of 2014, the GDP growth in the last quarter was 6.8%, which was also lower than the third quarter. The second reason is the changing of renminbi expectation of exchange rate. In this period, the renminbi expectation of exchange rate was negative. Investors thought renminbi would devaluate in the future. Therefore, they bought more dollar-denominated assets. The third reason is the Federal Reserve announced that interest rate of the US would be increased by 0.25% (Rushe& Kasperkev,2015). This move caused dollar appreciation, which brought negative influence to renminbi. The last reason is some spectacular investors tried to short renminbi, which cause renminbi in a high pressure. The governor of PBOC Zhou XiaoChuan warned spectacular investors to let them give up their plan of short renminbi in an announcement before spring festival (PBOC, 2016).

During this period, PBOC did not take any monetary policy about required reserve ratio, but used reverse repurchase policy for seventeen times in this period, in amount of three hundred billion yuan.

The third period (form Jan. 1. 2016 to March. 31. 2016.)

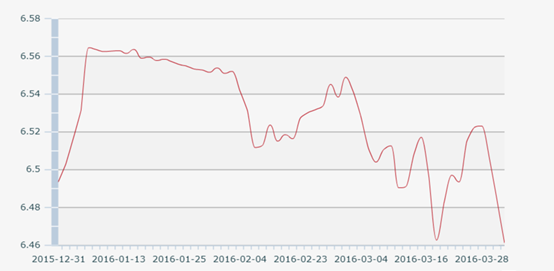

Chart 4: exchange rate from Jan.1.2015 to March.31.2016

Data and charts form PBOC(http://www.pbc.gov.cn/rmyh/108976/109428/index.html)

In this period, the exchange rate of renminbi to dollar was floating and had a decrease tendency. The highest point is 6.5314 in Jan.7th; the lowest point is 6.4612 in March.31th. The exchange rate of the start date of this period is 6.5032; at the end of this period, the exchange rate is 6.4612. Therefore, in this period, renminbi appreciated for 0.6%.

There are three reason about the exchange rate floating in this period. First, according to PBOC (2016), China economy turned to better, comparing with the first quarter of 2015, GDP growth 6.7% in the first quarter of 2016. Second, the Federal Reserve announced that the federal funds rate would stay the same. So the financial market does not influence by this factor. The third reason is yen and Euro appreciated to dollar. It showed that the exchange rate of renminbi to dollar is affected by a basket of currencies.

In this period, PBOC decreased required reverse ratio by 0.5% in Feb. 29.2016. In the open market, PBOC used reverse repurchase policy for fifty times in this period, in amount of 4.795 trillion yuan. The most important monetary policy was “PBOC required foreign bank engaged in offshore yuan trading to place reserves with the central bank” (Wall Street journal, 2016). By this monetary policy, China can release some pressure from the yuan.

An analysis about the efficiency of monetary policy

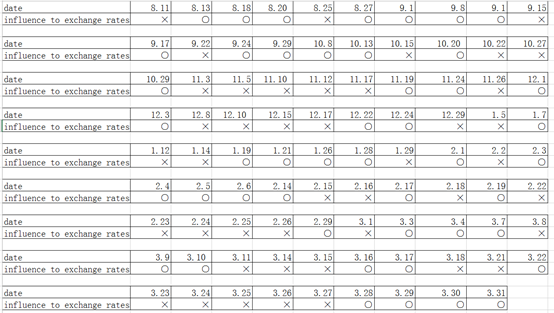

Monetary policies can help government manage exchange rate, however people still need to know the efficiency of these policy. All reverse repurchase policies are included in the figure 1. Symbol X means the reverse repurchase policy worded not well in that day. Symbol O means the reverse repurchase policy successfully influence exchange rate. X and O depend on the exchange rate changing of the following day. If the exchange rate increase, the symbol is X. On the contrary, the symbol is O.

Table 1: the efficiency of reverse repurchase policy from Aug. 10. 2015 to March.31.2016

There are 46 O and 43 X in this tabel. Therefore, we can find that reverse purchase monetary policy can influence exchange rate, but still cannot completely control exchange rate market. Because exchange rate is in a global market, the home country cannot control exchange rate by itself.

Except from reverse repurchase, the required reverse ratio is another significant monetary policy for home country. From During Aug. 10. 2015. to March.31.2016, PBOC had decreased required reverse ratio for three times and “required foreign bank engaged in offshore yuan trading to place reserves with the central bank” (Wall Street journal, 2016). Therefore, PBOC used required reverse ratio to influence exchange rate for four times. Table 2 will help people identify the effectiveness of required reverse ratio policy.

![]()

Table 2: the efficiency of required reverse ratio policy from Aug. 10. 2015 to March.31.2016

There are 3 O and 1 X in this table. If we read chart 1 again, we can find that required reverse monetary policy worked better than reverse repurchase policy. Required reverse ratio can influence exchange rate in a long term. However, reverse repurchase policy only can influence exchange rate in a short time. In the end, we can find that PBOC did a good job during this period. If not, yuan would already collapse.

Discussion about the influence of the exchange rate to different fields and groups of people

Exchange rate, exchange rate regime and monetary policy show some huge influence to global economy and politics. However, it is still important to identify how these issue influence some social aspects and different groups of people. This section would discuss about how exchange rate influence investors, common people, government, and domestic market

Investors

Exchange rate has a huge impact on investors, especially for international investors. The key goal of investors is to make their assets appreciated. Therefore, these people or institutions would try their best to find some assets, which have potential appreciation. When they invest a foreign country, they want to buy assets in a low exchange rate and sell them in a high exchange rate. By these market behaviors, they can reach their goal. However, exchange rates are not stable, when they have a negative expectation of a foreign country’s currency, they will sell these country’s assets before the currency devaluate. Some investors or institutions want to control the exchange rate of a specific currency to make profits, such as Hong Kong economy crises in 1997. If Hong Kong government cannot protect the exchange rate of Hong Kong dollar, Hong Kong’s economy would have destroyed. People always appreciate using normal market behaviors to make profits. But making profits basing on other people’s tragedy, people will remember these investors forever as a negative example.

Government

For government, the independence of exchange rate is an important aspect to represent the country is an independence country. If a country’s currency or exchange rate are controlled by another country, it is hard to say the country is independence. Because the country relies on another powerful country. If the powerful country suffers economy crises, the home country would suffer it too. It is also hard for the home country when the powerful country asks them to sign unequal treaties. Therefore, countries should keep their exchange rate independent.

There are two significant aspects for countries to keep their exchange rate independent. First, the independence should base on the great power of nation. Second, they should use efficient monetary policy to reduce financial risk. If monetary policies, which they use to manage exchange rate, do not good enough, some spectacular investors would destroy their economy. After the economy crises happen, the public trust of the government will be destroyed too. People may think they need a new government to help them through the crisis.

There is also a specific problem for China government. China has a high foreign exchange reserve. Most of foreign exchange reserve is US Treasuries. If renminbi appreciation too quick, these foreign exchange reserve must devaluate. If the exchange rate of renminbi remains the same level, the government and economy may suffer a high pressure. It is really a dilemma for China government.

Domestic Market

Exchange rate also have influence on domestic market by influencing export and import. When exchange rate high and stable, companies may try to export more goods but import less. Because export more goods can help them make more profits and let their profits appreciate. If exchange rates become lower, these companies may try to invest foreign to make more profits. So the domestic capital market is influenced by exchange rate. Exchange rate can help country transform its economic structure. Low exchange rate can make some companies do not produce some low price products which they can import them in a lower price, such as clothes and toys. High exchange rate is hard for companies to import some necessary techniques, because they cannot afford them. What they can do is produce more cheap goods and raw materials to make money.

Common People

Exchange rates have different influence to different class. First, high-income class may do not feel the pressure from exchange rate increase. Because they are rich enough, although exchange rate higher, they still can afford foreign goods. Second, poor people may feel little impacts form exchange rate changing. As a consumer, they may not afford import goods. However, their job may be affected by the changing of exchange rate. For example, a people work for a garment for several years, but when the exchange rate decrease, the garment would not receive enough order to make money. Because foreign companies decide to give these orders to a high exchange rate country’s garment, so they can reduce their cost. So the garment may decide to dismiss some workers, and the people may lose job. Third, the middle class may suffer the serious influences form the exchange rate changing. Because when exchange rate higher, they may not afford some goods that they used before. When exchange rate lower, they also face the risk of unemployment. It is difficult for middle class to live in a country that has an unstable exchange rate.

Conclusion

This paper talks about China exchange rate regime and tools of monetary policy in the first section to provide some basic knowledge for policy makers and students. In the second section, this paper analyzes changing of exchange rate of yuan to dollar in a period (Aug. 10. 2015 to March.31.2016). The effectiveness of China’s monetary policies is analyzed in this section that these monetary policies have positive effects to exchange rate but still cannot completely manage it. The last section is a discussion about how exchange rate influence society and people by analyzing what would happen in a high or low interest rate. This paper may help policy makers get familiar with China exchange rate regime. For new economics student, this paper may help them identify the effective of monetary policies.

Limitations

This paper discusses China exchange regime too briefly, just provides some explain of some terms in the first section. The second section is too short, and still need provide more data to identify the effectiveness of China monetary policy. For example, each reverse repurchase should give a clear number of money. So the relationship between the amounts of reverse repurchase and exchange rate may be clearer. The analysis method is very simple, just by the number of O and X. The last section lacks some academic sources to make these opinions become stronger. About language feature, this paper may be very boring, always have same sentence structure and some words appears for many times. Some sentences also may be confused and some grammar mistakes still exist in this paper, because some specific sentences translate from some Chinese reports. The last limitation is citation format, the citation format may in a mass and some sources are used for many times.

Reference Page

Currency peace. (2015). Retrieved May 08, 2016, from http://www.economist.com/news/finance-and-economics/21644205-devaluing-yuan-would-do-china-more-harm-good-currency-peace?zid=300

People’s Bank of China, 2010, from http://www.pbc.gov.cn/huobizhengceersi/214481/214545/214769/2847943/index.html

People’s Bank of China, 2010, from http://www.pbc.gov.cn/zhengcehuobisi/125207/125217/125922/125939/2814499/index.html

Xinhua news, 2009 from http://news.xinhuanet.com/ziliao/2009-05/22/content_11418998.htm

People’s Bank of China, 2013, from http://www.pbc.gov.cn/zhengcehuobisi/125207/125213/125431/125463/2881199/index.html

People’s Bank of China, 2009, from http://www.pbc.gov.cn/zhengcehuobisi/125207/125213/125437/125812/2848043/index.html

People’s Bank of China, 2013, from http://www.pbc.gov.cn/zhengcehuobisi/125207/125213/125443/125854/2895400/index.html

People’s Bank of China, 2015, from http://www.pbc.gov.cn/zhengcehuobisi/125207/125227/125957/2161441/2973791/index.html

People’s Bank of China, 2016, from http://www.pbc.gov.cn/zhengcehuobisi/125207/125227/125957/2161441/3016811/index.html

People’s Bank of China, 2016, from http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3059540/index.html

People’s Bank of China, 2016, from http://www.pbc.gov.cn/goutongjiaoliu/113456/113469/3016856/index.html

P (n.d.). China to Raise Reserve Ratio for Offshore Yuan Clearing Banks. Retrieved May 08, 2016, from http://www.wsj.com/articles/china-to-raise-reserve-ratio-for-offshore-yuan-clearing-banks-1453083342

Rushe, D., & Kasperkevic, J. (2015). Federal Reserve announces first rise in US inter est rates since 2006. Retrieved May 08, 2016, from https://www.theguardian.com/business/2015/dec/16/federal-reserve-us-interest-rate-rise-fed-funds-janet-yellen